How to make millions selling PDFs

Tim Ferriss's advice to "sell info products bro" taken to its logical extreme

Hello to the 1,380 people reading this, and a warm welcome to the 207 new subscribers since last week.

As a reminder, I’m Andrew Lynch, a small business CFO here in the UK. Net Income is a weekly breakdown of the interesting companies I find. But, confession time: I didn’t find this company. In fact, three Net Income readers mentioned it to me in the last couple of weeks, so I had to take a look.

What happens if you read Four Hour Work Week back in 2007, and decided, yes Tim Ferriss, you’re right, I should sell info products with no marginal cost? We’re about to find out.

One request: if you like this, please share it with a friend.

Let’s say you woke up this morning feeling particularly cruel and vindictive.

The scenario is this: you have a new starter in your organisation, and your mission, should you choose to accept it, is to make sure your new starter either fails, quits, or gets so burnt out that they leave the company in the next three years.

Step one, of course, is to watch this absolutely iconic noughties rom-com for some #inspo:

But let’s take that as read. What’s your gameplan to force someone out of their job?

I don’t have all the exact steps figured out, but I think we can all agree a plan would work if it ticked these boxes:

Pay is significantly under-market compared to their skill & education level.

Long hours expected regularly, with no overtime or bonus.

Pay is linked to tenure rather than performance — no matter how hard they work, they won’t make any more money.

Little or no onboarding, training or ongoing reviews, just chuck them into the job and expect them to figure it out for themselves.

But they’d best not screw up, because there’s a constant threat of external inspection AND YOU MUST SCORE HIGHLY OR YOUR LIFE IS RUINED.

High percentage chance of verbal, emotional, or even physical abuse from your customers, with whom you have to interact for hours at a time.

Well would you look at that? We’ve just described teaching.

In the UK, one in seven teachers quit in the first year on the job. A third of teachers who have qualified in the last ten years have left teaching. And another 44% plan to quit in the next five years.

In her earlier career, my wife was a teacher, and a good one. But she ultimately left teaching about two years after qualifying. When we compared the hours she was working to the amount she was being paid, it came out significantly below minimum wage. It just wasn’t worth it.

Of course there were other benefits. Long summer breaks, lucky dips in the lost property box, and that warm feeling of seeing someone reach their potential — but those benefits don’t pay the bills.

The most difficult bit of the workload to handle wasn’t the time in the classroom, or marking the kids’ books. It was lesson planning.

Let’s say you had to give a 15 minute talk at your job. It’s an important one, and you want to do well.

How long would you spend writing, planning and practising that talk? Significantly more than 15 minutes, I’d say. At least an hour, maybe more?

Whatever the actual answer is, it’s almost a certainty that you’d spend more time planning your talk than actually delivering it.

Now imagine you have to do five hours of presentations per day, five days a week. And if you screw up, the audience of 13 year olds laughs at you and tells all their friends how cringe you are.

The result is that teachers end up spending an inordinate amount of time on lesson planning. That burden is particularly hard for new teachers, who don’t have years of material to pull out when they need it.

But... what if there was another way?

What if your school, or the government, or some non-profit, provided a huge bank of teaching resources for you to download, use, amend, and remix to your heart’s content, all for free?

Well, that’s a pipe dream. The education system is too screwed up for that.

But what if a private, for-profit company provided a huge bank of teaching resources, for just a few pounds a month, and you had to pay for it out of your own pocket?

Eh, close enough, you’d say. I’ll do it.

This is Twinkl, the world’s largest provider of educational and teaching resources.

Twinkl’s origins and numbers

Twinkl was founded in 2010 by husband and wife duo Jon and Susie Seaton. Jon, a solicitor, was shocked at the amount of time his wife, Susie, was spending creating her own teaching resources.

In fact, Jon was in a very similar spot to where I was circa 2012. If comparison is the thief of joy, then I’ve been robbed blind.

Let’s examine the paths that the two of us have taken since that sliding doors moment:

Jon and Susie took the more difficult path, and it’s paid off handsomely. I don’t begrudge them that, I just wish I’d been smart enough to do the same myself.

What started as Jon and Susie creating PDFs and PowerPoints in their spare bedroom at 4am is now into an international company with over 1,000 employees.

And guess what?

Selling digital products with no marginal cost of goods sold is a great business.

(ahem get the model from this article and others in the Net Income store k thx bye)

Just how great a business? Well, here’s Twinkl’s 2022 P&L:

Yes, that’s a 71% gross margin, and a 42% net margin.

These numbers are not a one-off. The first time Twinkl disclosed a P&L was in 2016. Even back then, it was less than 1/10th the size, and it was still a wonderful business, and it’s just gotten better and better ever since:

From £5m in revenue and £2.5m in net income back in 2016, to £55m in revenue and £23.3m net income in 2022.

It’s a rocketship. Since 2016, they’ve grown revenue at an annual rate of almost 50%. And whether you’re looking at gross profit, operating profit or net profit, they’ve all grown at an annual rate of 40-50%.

What a phenomenal business.

Back to capital intensity again

You might remember that last week we looked at measuring capital intensity using the asset turnover ratio. Remember:

Asset turnover ratio = Revenue / average assets

It’s a measure of how effective a company is at turning what it owns into revenue.

Well, when you’re selling digital goods, you don’t need a lot of capital. Really all you need is a functioning website and a Stripe account.

So Twinkl does a marvellous job of turning its assets into revenue.

Firstly, Twinkl crushes a capital-intensive business like Center Parcs — its asset turnover is around 8x higher. That much should be obvious.

But even compared to relatively capital-light industries like consulting or SaaS, Twinkl is in a league of its own:

This is not a company that needs that much reinvestment as it grows. In fact the vast majority of Twinkl’s assets are either cash, or accounts receivable that’s about to become cash.

As a result, those lovely, thicc 45% net margins translate directly into distributions for the owners. How much in distributions, you ask?

£60m alone in the last two years.

Lovely stuff.

Twinkl’s growth model

One beautiful thing about Twinkl is that it’s recurring revenue.

Teachers — and parents — can sign up for a monthly membership fee of between £4.49 and £8.49 per month, depending on the level of access they want. The

There’s also a free tier with more limited access.

Let’s make some very basic assumptions:

The average membership fee is £6.24 per month (less VAT)

Prices haven’t changed since 2016

All revenue is membership fees

Then we can estimate the member growth over time:

Of course, with a bit of quick googling, we reveal that there are only about 500,000 teachers in the UK.

I spoke to a couple of teachers I know and they confirmed that yes, they know Twinkl. In fact they reckon every teacher knows Twinkl, purely through word of mouth and staff room chat — and they said they wouldn’t be surprised if basically every teacher has used it at some point, even if they’re not an active paying member right now.

So what do you do if you’ve maxed out your domestic market?

Go international, baby.

Back in 2016, Twinkl was doing £5m total revenue, of which £0.7m was international.

In 2022, they did £55m in revenue, and £18.5m of that was international. Here’s the split:

Since 2016 they’ve grown international revenue at a significantly faster rate that UK revenue, meaning that International is now about one-third of their total revenue, up from about one-seventh back in 2016:

Now, Twinkl has around 1,000,000 separate teaching resources for over 200 countries, in 60 languages. Look at this curriculum list:

Do you spot any gaps? I sure don’t.

But how? How did they do this?

They borrowed Facebook’s playbook.

Back in 2004, Facebook was only available for Harvard students. They grabbed that market until they were ubiquitous on campus. Then expanded to other universities, one by one, then to other countries, then finally, to everyone.

Uber was exactly the same. Started in SF, built up their reputation and product offering, then ctrl +C ctrl +V’d the model into lots of other cities, one by one.

The reason that strategy works is because they’re network businesses. Facebook is useful if other people you know are on it. Uber is useful to riders if lots of drivers are using the platform, and useful to drivers if lots of riders need a cab.

Twinkl did the same thing, but focused on each age category. They started in one age range, and built up a great bank of resources targeted at that age range. Then they leveraged their reputation and cashflow to create resources for the next age range, and then for international markets.

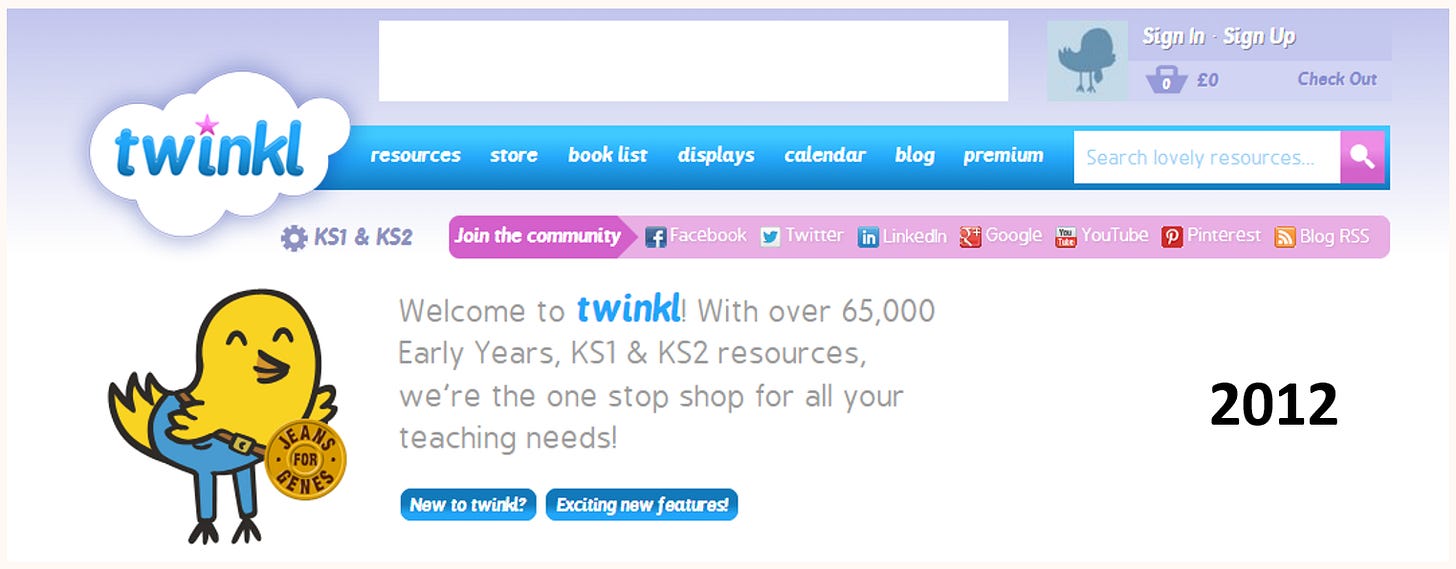

The great thing is, you can see this for yourself. We can use the Internet Archive’s wayback machine to look at Twinkl’s homepage for every year, going back to 2010, to see how their offering and branding has changed over time.

Here’s a screenshot of their homepage from early 2011:

Notice they call out their focus on early years and key stage 1, which is ages 3-7. That’s where they started, because that’s where founder Susie’s expertise was.

Here’s a screenshot from 2012, by which time they’d added key stage two (8-11 year olds):

By 2016 they’re pushing heavily into international markets, particularly in the US. Here’s their US homepage showing resources from pre-K up to 8th grade:

By 2018, they’re showing a full range of resources for both primary and secondary schools in the UK, meaning they cover ages 3-16:

And by 2023, they’re covering 200 countries, 60 languages, and targeting not just every teacher in the world but, thanks to Covid, thousands of parents too. They also have a huge social media following — as an example, their instagram page has 124k followers:

Twinkl now has such an advantage that they’d be a nightmare to compete with.

Firstly, they have an army of around 650 education experts around the world, always creating fresh new resources, which keeps their members coming back for more.

Secondly, the size of that teams mean they can respond instantly to current events and new product demand. As an example, when Stephen Hawking passed away in 2018, Twinkl responded, and fast.

Just a few hours after the news broke, Twinkl released some resources for teachers to be able to explain the impact of Hawking’s work to their students. That same day, teachers all over the world were using those resources in the classroom.

Do you want to start competing with that, today? I don’t.

It’s a beautiful strategy, executed to perfection. Bravo, Jon and Susie Seaton. Bravo.

Do you want a piece? Too bad

If you’re one of the many private equity investors reading this — and I know there are a good number of you, I see your email addresses — then take a look in the mirror, and tell me if this is broadly what you see looking back at you:

You’re just begging to provide Jon and Susie with ‘growth capital’ and ‘a chance to diversify your risk.’

If so, I’ve got bad news for you.

You’re too late.

I know how you feel. I’d give my right arm to invest in Twinkl.

But alas, my right arm is not worth £150m, which is what Vitruvian Partners are rumoured to be investing, for around a 30% stake. That values the company at £500m, or around 21x earnings based on the 2022 net income number of £23.3m.

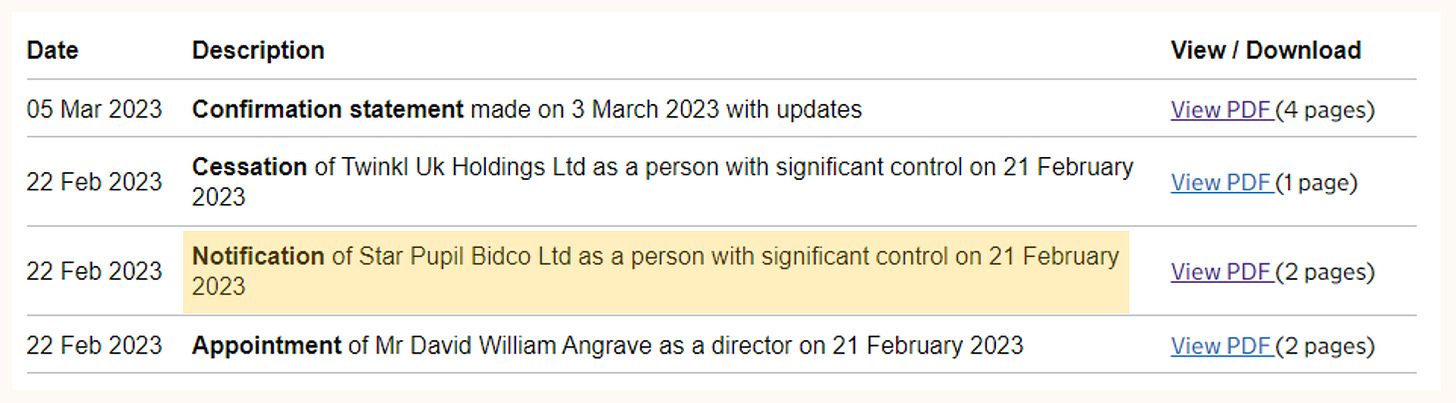

And it looks like the transaction closed on 21st February of this year, with the appointment of a new director, and Star Pupil Bidco Ltd becoming a person with significant control of Twinkl Ltd:

Now, bear with me as we walk through the corporate structure of a PE transaction:

Start Pupil Bidco Ltd is 100% owned by Star Pupil Topco Ltd. Star Pupil Topco Ltd is in turn owned at least 75% by Twinkl UK Holdings Ltd, and between 25 and 50% by Vip IV Nominees Ltd (a Vitruvian company). Lastly, Twinkl UK Holdings is 100% owned by Jon and Susie Seaton.

Not all of the updated shareholdings have been disclosed yet, but here’s my best guess:

And if all that is too much work, just look on Vitruvian’s website and you’ll see it right there:

So the transaction is done and dusted, and you’re too late to get your piece of the pie. Vitruvian have already grabbed their 25% of an absolute cash machine.

And Jon and Susie?

Jon and Susie are sitting pretty with about £150m, and that cash is probably sat in Twinkl UK Holdings.

Their nest egg of £150m is now ready to be deployed into all manner of other investments, property, trusts, or charitable causes. They’re probably also ploughing money into Twinkl Hive, their startup accelerator, in a desperate effort to figure out how to not get competed away by ChatGPT in the coming years.

And thanks to a sliding doors moment a decade ago, I’m here. Grafting away at this post, in the vague hope that you’ll like and share it with other P&L nerds like you and me. I do not have £150m, I have no startup accelerator, and no PE firms are returning my calls about investing in Net Income (yet).

But of course, as we mentioned earlier, comparison is the thief of joy.

*sobbing noises*

Carveouts

I got into a brief Twitter debate about someone making the outlandish claim that “AI just killed Microsoft Excel.” I lept to defend my beloved Excel on behalf of Microsoft, leading to Daryl’s wonderful zinger:

Well played sir.

Speak soon.

Andrew

What other sectors/industries do you see this business model+ product offering working in ?

Need a write up on corporate structuring; how HoldCo’s work etc, and like I said in my comment on the Gymshark post, just an in-depth explainer on stock options/RSUs, how it all corporate governance/structuring works in general..