Gary Mead's million-pound empire of brown gold

A Dirty Jobs story to make Mike Rowe proud

Hello to the 273 people reading this, in particular to the 124 new subscribers since last week. Not every post is about a multi-million pound SaaS company — we’ve got something very, very different in store today.

As a reminder, I’m Andrew Lynch, a small business CFO here in the UK, and Net Income is a breakdown of the interesting companies I come across. If you like this, please share it with a friend.

There’s a certain democracy to pooping.

No matter who you are — you, me, the King of England, the President of the United States, and the person who does the President’s dry cleaning — at some point in the last day or two, we’ve all had to sit down and perform this most basic of bodily functions.

(If you haven’t, please see a doctor urgently, or at the very least, eat more fibre.)

And when people have been doing something for thousands of years — eating out, building homes, swimming, watching plays, and yes, pooping — there’s probably a profitable business in that niche.

That brings us to Gary Mead, the poop millionaire of Chelmsford, Essex.

Gary’s story begins in the late 90s. At the tender age of 22, he started a small property management company in his home town of Chelmsford, Essex, about 30 miles northeast of London. According to his LinkedIn profile, he grew it every year for five years in a row, achieved profitability, and sold it. A successful exit by the age of 27 — not bad at all.

Possibly just to prove it wasn’t luck, Gary then started a small property management company in his home town of Chelmsford, Essex. He grew it every year for three years in a row, achieved profitability, and sold it. Again.

If you take nothing else from this article, learn this: if Gary Mead ever sells you a property management company, make sure you include a non-compete clause.

As a result, at just 30 years old, Gary had two successful exits under his belt. Likely holding some capital and a well-earned degree from the University of Hard Knocks, Gary scouted around for the next chapter in his career.

What next for this intrepid entrepreneur? Go for the property management three-peat? Start a petroleum-focused software business?

Not for young Gary. No, Gary saw his future paved with brown gold.

The portaloo business

Let’s make sure we’re all on the same page first.

This is a portaloo.

You might know them as porta-potties, chemical toilets, builders’ loos, mobile toilets, or “blue lavs.” Yes, I made that last one up.

You’ll come across these at construction sites, festivals, weddings and the like. Basically, anywhere there's a large group of people and nowhere to do your business. You can get fancy ones with hand dryers and sinks, or more basic units like the ones in the picture.

In 2003, Gary Mead founded Euroloo. Euroloo rents portaloos to you, for a fee, including drop-off, pick-up, and weekly servicing.

This is what Mike Rowe would call a Dirty Job. When these portaloos are dropped off on site on day one, they’re clean. When they’re picked up again on day seven, they are not. Someone has to make them clean again before renting them to the next customer.

That’s both a blessing and a curse. It’s a curse because, you know, you have to clean up poop. For more detail on this subject, check out this article from the wonderfully named company Poles and Holes:

“A good pair of gloves and a spray bottle full of cleaner is all it really takes to keep a portaloo looking like new!”

— Poles and Holes (2023), “How do you clean a portable toilet?”

It’s a blessing because grads from Harvard Business School and the LSE don’t want to go into this business. It’s not glamorous, it’s not sexy, and you probably don’t get admiring looks when you talk about it at the dinner table.

That’s great, because you don’t want to be competing against HBS and LSE grads. You want to compete, as Nick Huber says, with the type of person making a lot of money and using a fax machine. You are more likely to find those people in an industry like portaloos. And with some smart use of technology, you can out-compete them.

SEO works with poop too

Euroloo are doing a couple of things you don’t usually see from companies in industries like this.

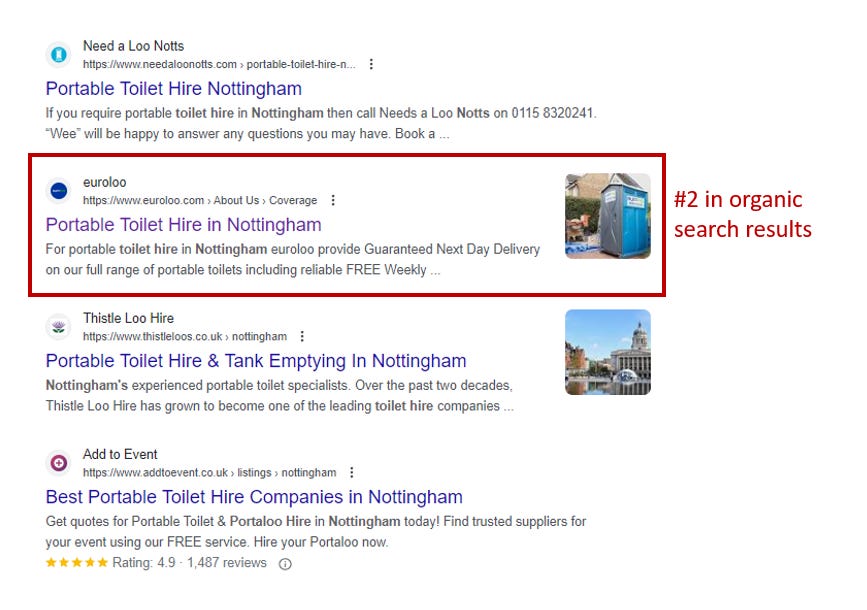

Firstly, they’re putting time and money into paid search. If you google “portaloo hire [city]” you’ll see them come up. I did this for my city, Nottingham, and Euroloo are #2 in the sponsored search results:

and they’re also #2 in the organic search results:

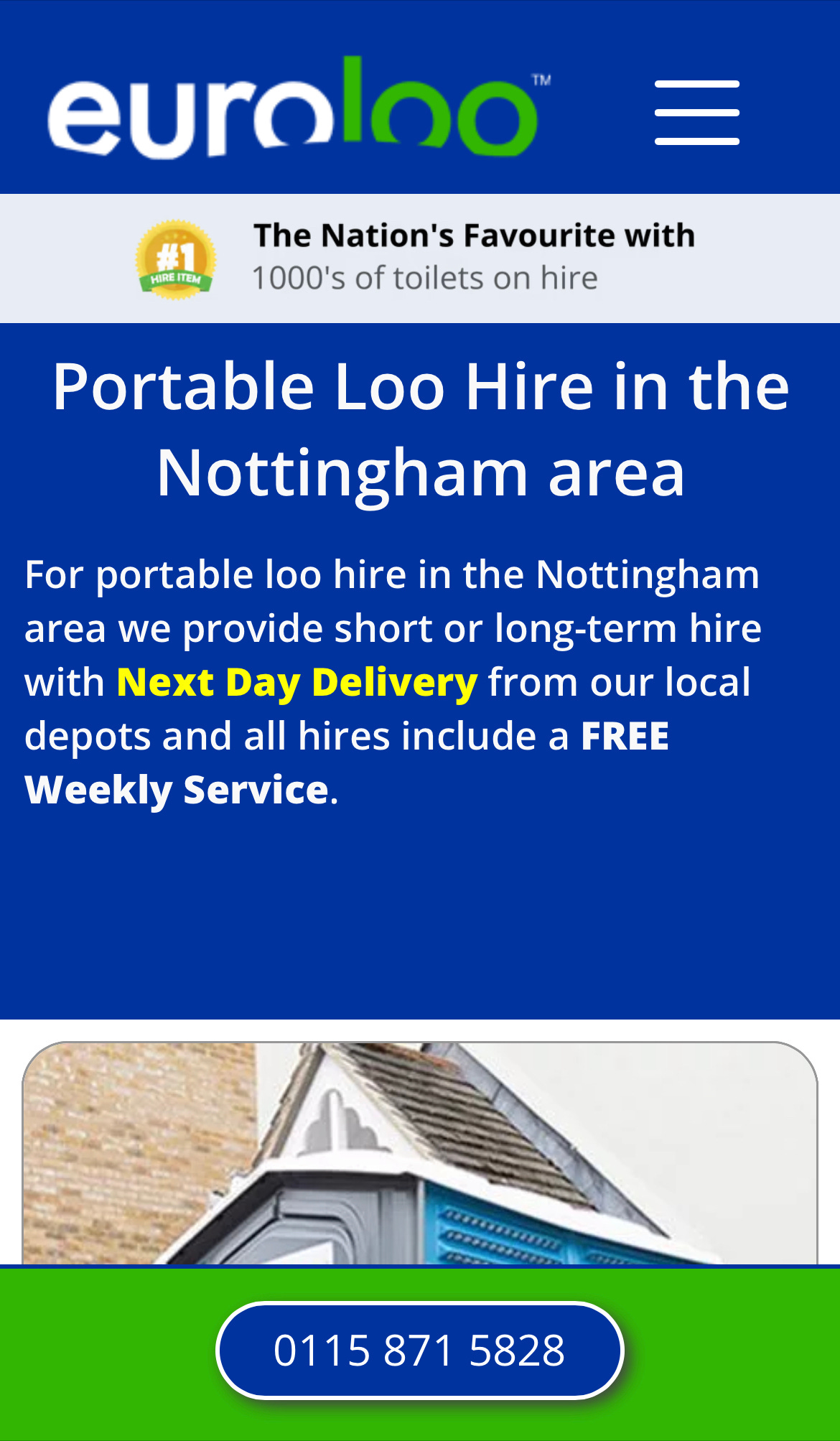

If I click through on mobile, I’m taken to this landing page, which makes them look like a Nottingham-based company, and they include a phone number with a local area code too.

But wait! If I google “portaloo hire Manchester,” they’re the #2 sponsored result again. If I click through, I’m taken to a different landing page, with a different local phone number, which makes them look like a Manchester business:

They also have a very easy quote process that you can fill out in seconds, which then passes all your details to a sales rep to get back to you.

This is good SEO and paid acquisition. A solid marketing and sales funnel. Not something you usually associate with a business or an industry like this.

Is there money in the portaloo business?

Short answer: yes.

Long answer: yes, definitely, and we can do some analysis to figure out how much.

As usual, I dove into Euroloo’s financial statements. The first thing we should highlight is that these are audit exempt accounts. The UK government doesn’t require you to get a full audit of your financials if you meet two of the following three criteria:

an annual turnover of no more than £10.2 million

assets worth no more than £5.1 million

50 or fewer employees on average

Let’s take a look at the balance sheet.

Total assets of £4.7m, which is under the threshold. Later in the financials, they also disclose the average number of employees as 93:

That’s over the threshold. We can therefore deduce that their revenue must be less than £10.2m — otherwise they would have had to undergo an audit and submit a full P&L.

Fear not. Even without a P&L, we can figure out a lot about this business. Let’s do some maths.

How to back into a P&L

We start with the balance sheet. Let’s take another look.

The key figure here is the retained earnings. That’s the total cumulative profit the company has made throughout its existence, less any dividends paid out in that time.

In Euroloo’s case, retained earnings went from £3.1m to £4m in the latest financial year. That means that after tax AND after any dividends paid to owners, Euroloo made £900k profit.

The UK corporate tax rate is 19%, so £871k is the after-tax profit, meaning the pre-tax profit must be £1.075m. Remember, we also know their revenue is less than £10.2m, so these are decent margins.

They also disclose a total depreciation charge for the year of £410k. If we make a reasonable guess around their people costs of an average of £50k per year per person, we can come up with a range for their revenue and margins:

Revenue is somewhere between £6.1m and £10.2m, with margins between 10.5% and 17.5%.

Lastly we can estimate their revenue based on the accounts receivable. Euroloo are selling to trade customers, probably on credit terms, so those construction crews and event management teams are paying for their portaloos after they’ve used them.

On 31st March 2022 they had £422.8k outstanding from customers. That does include 20% VAT that they can’t count as revenue, so if we strip that out, then assume 14 days credit terms, we come up with a revenue estimate:

Somewhere in the £9.2m range, which lines up with what we know before.

Lastly, just for fun, I got a quote from Euroloo. It’s £32.50 for a single portable toilet per week, plus the same in delivery and collection fees:

The small print says the minimum period is 4 weeks, for a total of £195 plus VAT. Including delivery and collection, that works out as £48.75 per week.

If their revenue is around £9.2m and each toilet rents for an average of £48.75 per week, we come up with a total of 188,438 toilet hire weeks per year:

Let’s guess that each toilet is in use 90% of the time to account for time spent picking up, cleaning, and delivering.

Then with one extra bit of info from their accounts — that they’ve spent £3.2m on plant and machinery (presumably toilets), we can see our £9.2m guess on revenue is about right if each toilet costs £795.88.

And according to ToiletsForSale.co.uk we’re in the right ballpark:

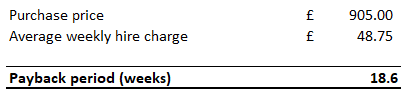

Lastly, this tells us that the real business here isn’t buying expensive assets and renting them out. Portaloos aren’t that expensive. If you buy every toilet brand new for £905, and the average weekly rental is £48.75, then the toilet pays for itself in less than 5 months.

No — as my friend and incredible entrepreneur Charles Burdett points out, this is a logistics and distribution business. The trick here is making sure that your 4,000 portaloos are on site, earning income, as much as possible.

So what’s their secret?

The secret sauce

Given everything we know so far, our best guess is that my man Gary Mead has a business with around £9m in revenue, a fleet of around 4,000 portaloos, netting him at least £900k a year, while employing 93 people in the process.

What I love is how Gary describes the secret sauce. The engine of growth. It’s word of mouth and repeat business.

How do they drive that word of mouth? What ensures their incredible reputation?

Gary’s LinkedIn page reveals all:

Did you get that? Their secret is:

• being easy to work with

• doing what they say

• being friendly and customer-focused

• being trained and good at the job

These principles are not rocket science.

Euroloo is a phenomenal example of, as Charlie Munger says, “taking a simple idea, and taking it seriously.”

The Euroloo playbook is:

Pick an unglamorous industry.

Focus on operational and customer excellence.

Layer in some technology.

Keep at it for 20 years.

That’s what Gary Mead has been doing since 2003. Over that time he's built an incredible business worth millions that provides a great living for him, his family, and his team. I love to see it.

Anyone could do this. It’s not easy, but it is simple.

Carve outs

In today’s episode of My First Million, Sam and Shaan talk about Petex, the company I covered last week. As you’d expect, Sam and Shaan have some great insights that I didn’t hit on. Recommend a listen if you want more.

I’m currently reading Fire Weather: A True Story from a Hotter World by John Vaillant. It’s the story about a tremendous wildfire in Alberta, Canada, which is Canadian oil country — it’s really the story about how what goes around, comes around. Our reliance on fossil fuels, leading to climate change, leading to extreme weather events which devastate a town that benefited from our reliance on fossil fuels. John’s an incredible writer — if you haven’t read his book The Tiger, I highly recommend that too. It’s one of my top five non-fiction books.

Succession finale 👏👏👏 Loved it. No spoilers here, but my god, what a show. I’m legitimately sad it’s over, and I’m already writing a spec script for a show about the Logan Roy origins story.

Speak soon,

Andrew

👏👏 the British Matt Levine??! Great read dude. Im guessing a big chunk of non people costs is marketing spend. Any thoughts on how to model that out?

Great breakdown again Andrew! New sub that found out about you via the MFM Pod! Financial statements are foreign to me but I'm learning slowly thanks to you! What do you think Gary's depreciation charges for the year of £410k are? Stock bought with debt? Maybe I'm missing this in the financial statement and it would be outlined differently if there was debt? I read your Centre Parcs piece just now too so maybe I'm mixing up the debt stuff! How can I learn to do what you do here?!