The Scottish SaaS business with 71% operating margins

A stunning cash generating machine

Hello to my wonderful 149 friends reading this, in particular to the 69 (lol) new subscribers since last week. If we keep doubling every week, I estimate that everyone on Earth will have signed up in the next 6 months, which I’d consider a success.

As a reminder, I’m Andrew Lynch, a small business CFO here in the UK, and Net Income is a breakdown of the interesting companies I come across. If you like this, please share it. If you don’t like this, feel free to close your browser, go outside, and touch some grass.

There are lots of things I associate with Scotland. Robert Burns. Haggis, neeps and tatties. Clamouring for independence. Deep-fried Mars bars. The two famous Williams: William Wallace of Braveheart fame, and Willie the groundskeeper of Springfield Elementary School.

What also comes to mind is a key economic driver for Scotland: North Sea oil.

Aberdeen, up in the north east of Scotland, is the European capital of oil. It’s the UK’s answer to Houston — a town heavily reliant on the energy industry for its economic output (at least until Brewdog came along).

Wikipedia estimates that between 1960 and 2014, approximately 42bn barrels of oil were extracted out of the North Sea, all off the coast of Scotland, across all of these different exploration sites:

That’s a lot of money sloshing around.

The wonderful thing about capitalism is that any time an industry springs up, like drilling for oil, ancillary and supporting industries sprout up as well, ready to serve that market and capture some black gold for themselves.

Which brings us to 2nd August, 1990, when Abdelhamid Guedroudj founded Petroleum Experts Ltd.

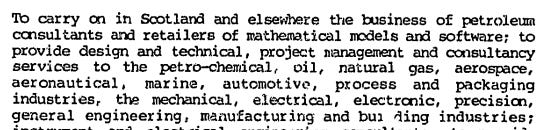

The original articles of assocation are still on Companies House, in microfiche. Guedroudj stated the business purpose as:

Petroleum consultants and retailers of mathematical models and software. Sounds complex.

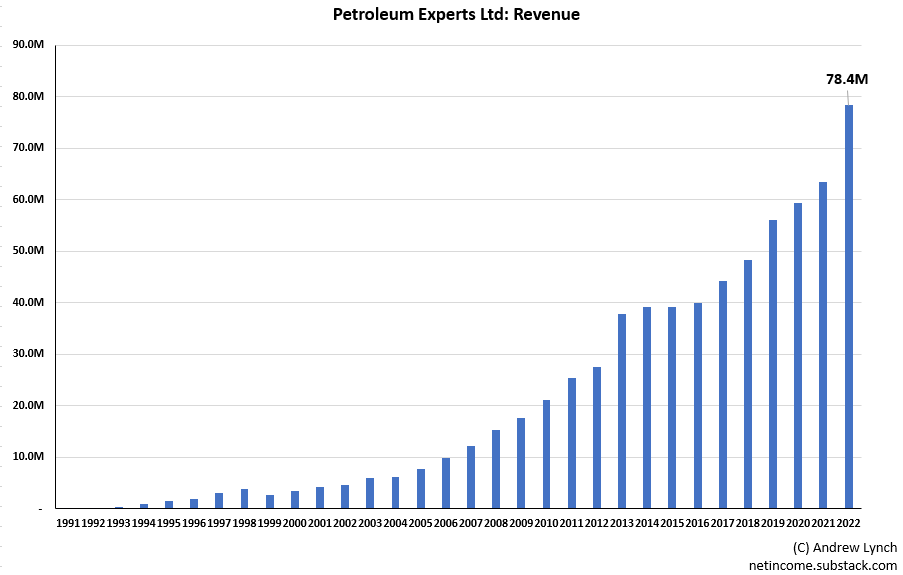

Since that auspicious day in 1990, how has that company fared?

Pretty fucking well.

The company now trades as Petex, and is one of the biggest software providers to the oil and gas industry. Their core product offering is IPM, Integrated Production Modelling, which is made up of several products with descriptions like “multiphase network modelling and optimisation” and “thermodynamics fluid characterisation package.”

You get the picture. This is highly technical, specialist software, sold into an industry that cares an awful lot about getting these things right, who use this software as the backbone for some of their most important operations. When you combine that with the fact that software is the best business model of all time, you get a wonderful business.

This is what’s known as VMS, Vertical Market Software. Finding and acquiring small VMS companies like this is why Constellation Software has been one of the best-performing stocks in the world over the last 20 years.

Here is Petex’s full Profit & Loss statement. Honestly, this might be the best P&L I’ve ever seen for a company this size:

Let’s start with the obvious. This is a wildly profitable business. 96% gross margins on £78.4m of turnover is just insane. Yes, software is the best business model in the world because the marginal cost of goods sold is as close to zero as you can get, but even among SaaS companies, Petex stands out.

Which makes perfect sense when you think about it in context. Imagine you’re running an oil rig that extracts hundreds or thousands of barrels of oil per day. Brent Crude is currently trading at about $75 per barrel, so every hundred barrels is $7500 in revenue.

Your IT guy comes up to you and says, “Boss, Petex just put their prices up by 10% this year. I think we could save $3k annually if we switched software providers to another thermodynamics fluid characterisation package instead.”

You tell him to piss off, don’t touch a thing, and just make sure nothing breaks. A measly $3k is nothing in the grand scheme of your huge capex-intensive business. Petex put their price up 10% and everyone carries on as before.

That’s the power of sticky software.

Market comps

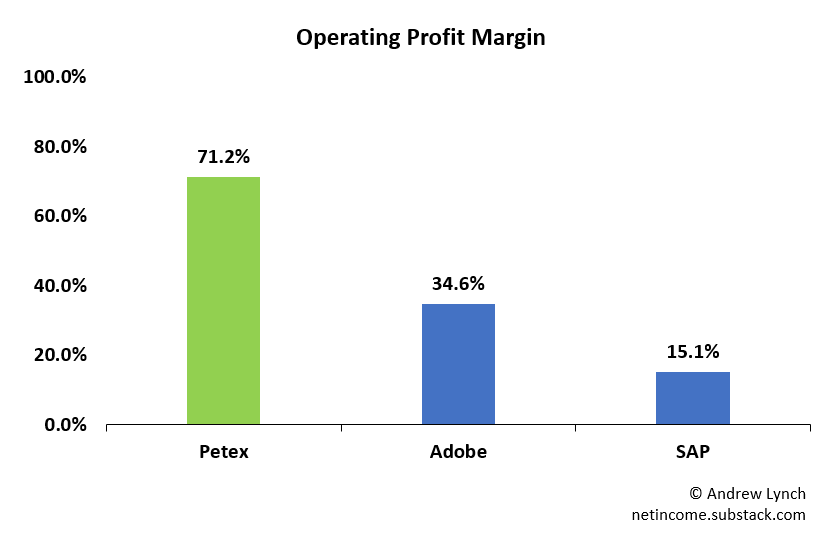

That pricing power and operational criticality means Petex enjoy extraordinary margins, even compared to other software companies. Here’s a quick comparison to Adobe, a world class consumer & pro-sumer SaaS company, and SAP, the stickiest software in the world:

Petex enjoys gross margins significantly better than both of those comparables. And the picture looks even rosier when we look at operating profit margin, which is the real measure of profitability given the fact that the bulk of a software company’s costs tend to sit in opex:

71% operating margins. I appreciate that in sheer revenue dollars, Petex is significantly smaller than either Adobe or SAP, but it gives you an idea of their outperformance.

Given that they’re UK based, they’re only paying UK software engineer salaries too. Looking at the last 10 years of data, their average all-in cost per employee is around £101k per year.

Interestingly, cost per employee spiked massively in 2022, implying some sort of large one-off bonus or payment to staff — despite which they still achieved 60% net margins.

In 2022 Petex discloses that they had 86 employees. That translates to £911k revenue per employee. It doesn’t take a genius to work out that if people are your main cost, and revenue per employee is £700k higher than cost per employee, you’re probably doing well.

Tax avoidance — or, tax incentives?

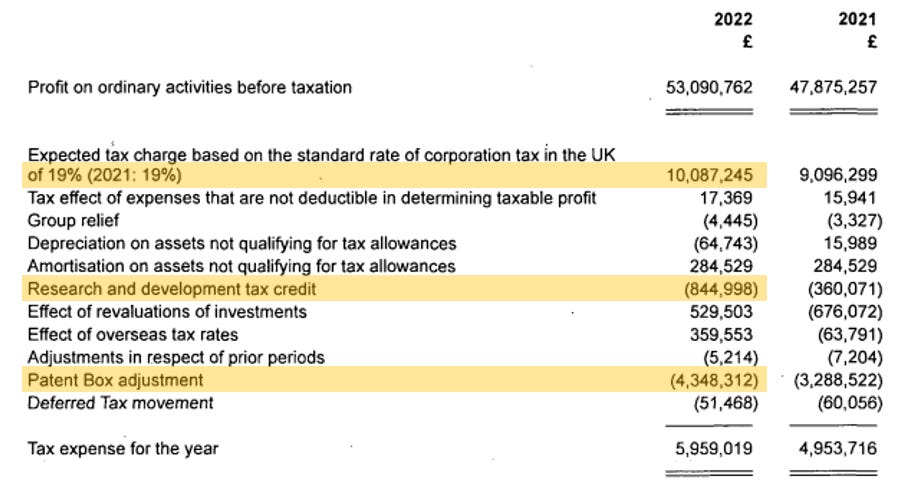

One thing to highlight on the P&L is the effective tax rate, which is just 11.2%. For 2022, the UK corporation tax rate was 19%, meaning all else being equal, I’d expect Petex to be paying around £10m per year in tax. Instead, they’re paying just under £6m.

Here’s the tax reconciliaton from their accounts:

There are two big things going on here.

R&D tax credits: companies are entitled to claim back a large percentage of the money spent on R&D, as long as the work meets certain criteria.

Patent box adjustment: companies that hold patented intellectual property that is commercialised in the UK pay just 10% tax rates on the income generated from that IP.

The patent box is the real golden goose here — it’s worth £4.3m per year to Petex, as it reduces their income tax rate from 19% to 10% on a certain chunk of their income.

Given the fact that Petex says the patent box adjustment is worth £4.3m, and we know it reduces the effective tax rate by 9%, then we can figure out how much of their £53m profit is attributable to that IP.

So 91% of Petex’s profit is generated through patented IP, meaning they’re only paying 10% tax on 91% of their profits. That’s a massive advantage.

It’s also exactly what the patent box tax relief is designed to do: get companies to create, patent and commercialise IP here in the UK. In this case, it’s working.1

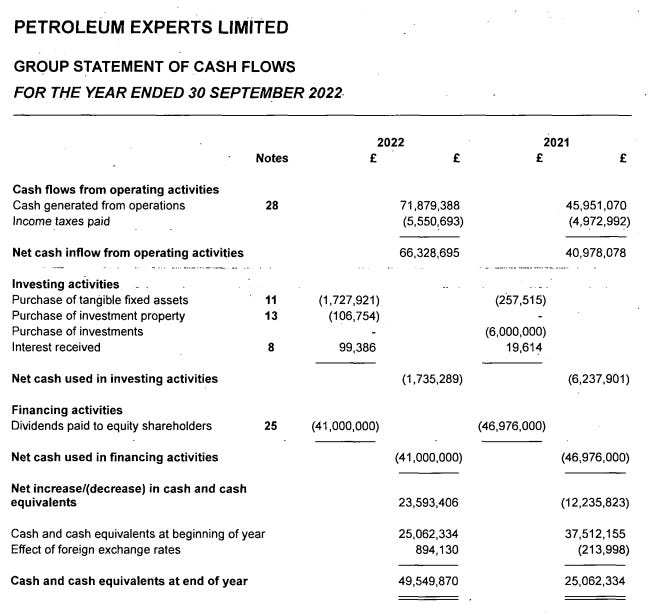

Cash machine

Remember in 2022, Petex’s total revenue was £78.4m.

From that £78.4m revenue, they generated £66.3m of cash from operations.

With only minor capex requirements of £1.7m, that leaves a huge £41m to be paid out as dividends, while still increasing cash balance by £23.6m in the year.

Can I just stress that again? £78.4m of revenue turned into a £41m dividend. Ignoring the owners’ personal tax situation, for every £1 of revenue, £0.52 went directly into the owners’ pockets as a dividend.

Valuation

This business is a stunning wealth generation machine.

This is why, a few years ago, founder Abdelhamid Guedroudj was named as the 4th richest man in Edinburgh, with an estimated fortune of £313m. It’s unclear exactly how much of this business he owns today — the company is wholly owned by a HoldCo in another country — but I don’t think they’ve ever taken outside money. Their websites states:

All our product development activities are self-financed, which enables us to focus on technical innovation and quality of technology, instead of the search for external funding.

I’d have to imagine the business is worth at least a 10x multiple of earnings, which puts it around the £500m mark. Given the Scottish Herald’s estimate of Guedroudj’s net worth, it’s not outlandish to guess that he owns over 75% of this business.

And until someone on Twitter sent me this company, I’d never heard of it.

An incredible story. I love that you can quietly build a company in a niche like this — that through years of hard work and grit pays off, hugely. This is 10/10 execution applied to a 10/10 opportunity space, turbocharged by some healthy tax credits along the way.

Carve outs

I’m currently reading How Big Things Get Done, a look at megaprojects like building skyscrapers or massive IT projects, and what makes them either succeed or fail. Fascinating so far.

Obviously I’m watching the final season of Succession. I still strongly agree with Owen’s assessment.

Speak soon.

Andrew

Update: my friend Tom Myers pointed me in the direction of their patent, which is here. Filed in 2014, it’s a patent for “method of monitoring a reservoir system using image well technique,” with an abstract title of “reservoir modelling using flux pairs to specify boundary conditions,” and if any of that means anything to you, you’re smarter than me.

Ended up on a YouTube rabbit hole, and now I'm here via My First Million.

https://youtu.be/c47F9Oxp_Dc