The boardroom drama behind Gymshark, one of the UK's fastest-growing companies

Haven't we seen this movie before?

Hello to the 1,667 people reading this, and a warm welcome to the 144 new subscribers since last week.

As a reminder, I’m Andrew Lynch, a small business CFO here in the UK. Net Income is a weekly breakdown of the interesting companies I find.

This week’s deep dive is a look at one of the UK’s fastest growing companies, Gymshark, and the drama, intrigue and behind-the-scenes moves that took place as the company scaled from £10m to £500m/yr.

One request: if you like this, please share it with a friend.

Note: this is part 1 of the Gymshark story, For part 2, click here.

What do Andre Agassi and Prince Harry have in common?

Aside from a slightly brattish demeanour and a receding hair line, I mean.

The answer I was thinking of is: they both used the same ghostwriter.

Agassi’s wonderful, brutally honest memoir Open, and Prince Harry’s salacious, baffling, gossip-filled book Spare were both penned by the same man, JR Moehringer, a Pulitzer Prize winning writer.

Moehringer is also the man behind Shoe Dog, the autobiography of Nike founder Phil Knight, which in my mind is probably the best business book I’ve ever read.

Most autobiographies suck because they give way too much time and space to the boring parts of the story:

the person’s family history going back five generations (I don’t care)

what the person’s life is like now they’ve succeeded (boring)

Shoe Dog, on the other hand, covers the interesting part that we all love to read: the drama.

It’s full of stories about Knight’s hard times building Nike: disagreements with co-founders, his shortcomings as a leader, and constantly being broke in a cash-hungry business — all while pursuing a singular vision of what he wants the brand to be.

This week we’re looking at a company that now competes with Nike, and has just as much drama in its story: Gymshark.

Gymshark was founded by 19-year-old best friends Ben Francis and Lewis Morgan back in 2012, and since then their growth has been meteoric.

By 2016 the company was already doing £13m in revenue, and it’s been on an absolute tear since then, reaching nearly £500m of revenue in 2022.

Gymshark is now a unicorn, probably worth around $2bn, and it’s made its founders fabulously wealthy. It recently opened its first flagship retail store, in the heart of London, and growth continues at breakneck pace, with ambitions to continue to expand in the US and Asia.

Ben Francis, MBE, is now 31, and continues to be CEO of Gymshark today, with a vision to create a truly iconic, global, British brand like Jaguar, Aston Martin, or Burberry, and in the process, to rival Lululemon, Nike, and Under Armour as a top-end sportswear company.

Ben now owns 71% of the company, and is worth around £1bn.

Co-founder Lewis? He owns 0% of the company, having resigned his role in 2016, and selling off his shares in 2020.

Don’t cry too much for him: he’s rumoured to have sold his shares for around £100-200m.

But still: that’s only like a tenth of what his fellow co-founder Ben is worth.

What the hell happened? Let’s get into it.

Gymshark’s numbers

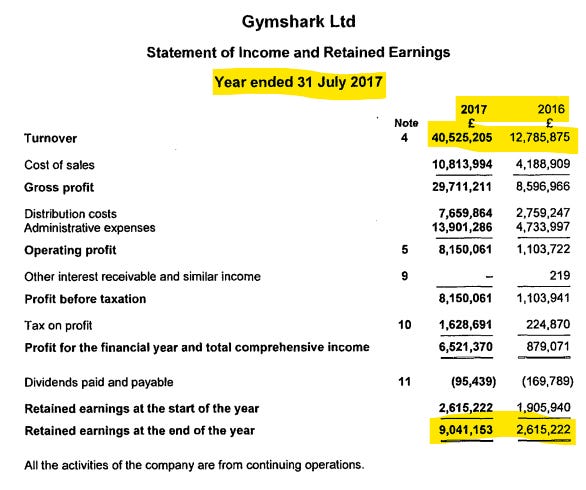

First, let’s dive into Gymshark’s P&L.

From their founding in 2012, it took Gymshark just 6 years to get to £100m in revenue, and they’ve continued to grow at a tremendous rate since then. Here’s their P&L over the last five years:

Now Gymshark is a business doing ~£500m per year in revenue, at 65% gross margins, and net margins of 5-10% per year. Not only that, but it’s still growing revenue at more than 20% year-over-year.

Where does that put Gymshark in its mission to become a global sportswear brand?

Let’s compare it to the three brands that Ben Francis himself mentions: Nike, Lululemon and Under Armour.

In terms of revenue, it’s no surprise that Nike is the absolute behemoth of the industry, doing nearly $47bn a year in revenue.

Of course Nike has had a 50 year head start on Gymshark, so it’s not really a fair comparison.

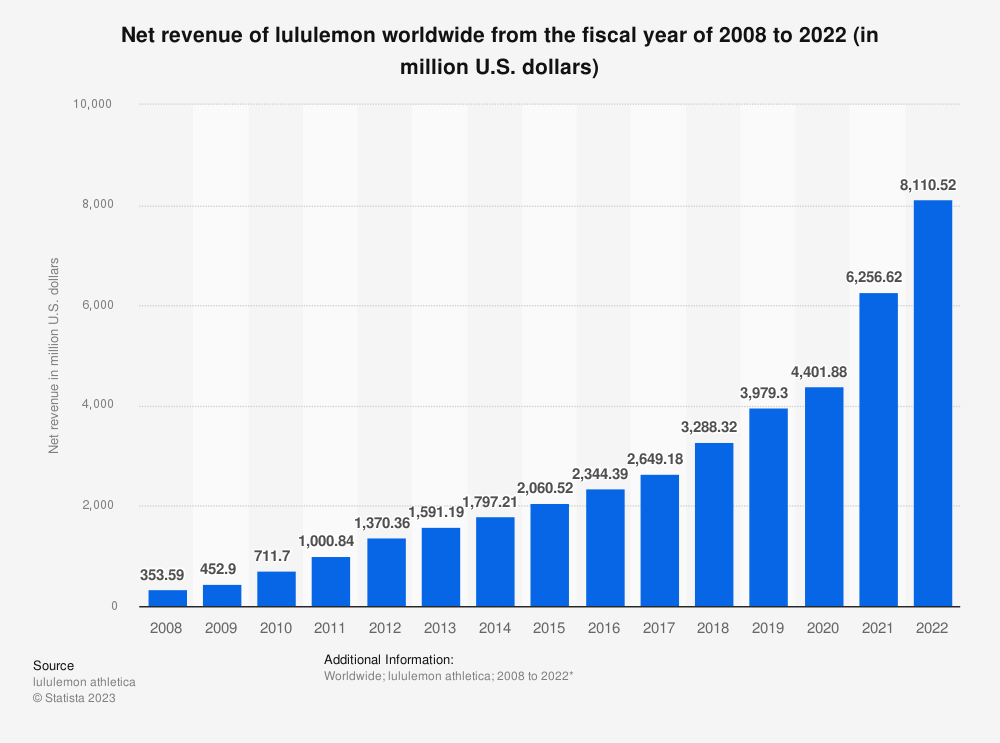

Lululemon is a better analogy — the company was founded in 1998, and after 10 years in business, Lululemon went public, and was doing $353m in revenue at the time. Adjusted for inflation, that’s about $500m in today’s money.

Which means that in terms of revenue, Gymshark is ahead of where Lululemon was at the same point in its journey.

The flipside of that argument is that Lululemon then went on an absolute tear for 14 years, growing at a compounded rate of 25%, and now does over $8bn a year in sales:

and while Gymshark is growing faster than Nike and Under Armour, Lululemon is still the leader of the pack:

which is all the more impressive when you consider that Lululemon’s revenue is more than 13x that of Gymshark.

Here I should declare a conflict of interest:

I’m an unofficial brand ambassador for Lululemon.

It’s a unilateral agreement that Lululemon HQ is unaware of, but it basically means I always wear their clothes and walk around telling people how amazing they are.

side note: yes, sponsorship slots are available! hmu lulu xx

One thing Gymshark has in its favour vs legacy brands is on gross margins. As a native DTC brand, Gymshark may pay eye-watering fees to Shopify, but it doesn’t have the same cost of physical retail stores that other brands do, meaning higher gross margins:

but then again, being a DTC brand, if it’s not Shopify picking your pocket, it’s all that pesky sales and marketing expense, or the breakneck costs of rapid growth (although Lululemon still does fine).

The end result is that Gymshark has the lowest net margins of the comparison group.

Gymshark’s a great business, and if it can keep growing, it could definitely find itself in the same class as the comparison companies. It’s not there yet — but it’s done pretty damn well for business that only recently celebrated its 10th birthday.

It’s even more impressive when you consider the tumult and drama that Gymshark has gone through in its short history.

Key lesson: pick your co-founders carefully

Gymshark was founded by two best mates, Lewis Morgan and Ben Francis, back in 2012. Both keen fitness enthusiasts, they’d tried their hand at a couple of different business ideas in the gym and fitness space, none of which quite took off. Gymshark was another of these business ideas — it was originally intended to be online supplement store.

One day, so the story goes, Ben found himself frustrated at his inability to find good gym clothes that fit. (I’ve had the same problem because I’ve got such swole thighs. Seriously.)

So Ben and Lewis pivoted to making and selling gym clothes — and it worked! Instant traction.

At the time, Ben was working at Pizza Hut, making minimum wage, and sewing clothes in his parents’ garage, and he kept doing so until Gymshark had well over £100k in revenue, until finally Lewis and Ben both agreed to go full-time on Gymshark.

It’s right here, right at the beginning of the story, that the seeds of the drama are sown:

The two co-founders are best mates.

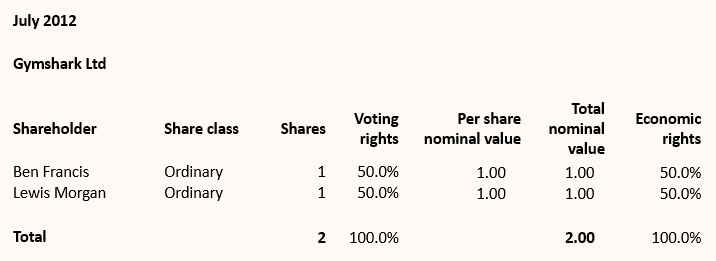

Each co-founder had an equal 50/50 stake in the business.

“Let’s keep it simple,” they said. “We’ll split everything right down the middle.”

So they incorporated Gymshark Ltd. The company had two shares, and they each owned one of them:

They also, according to Ben, didn’t really have any structure or clear roles and responsibilities. When you don’t have a clear split of roles, and neither one of you can outvote the other, that’s a recipe for disaster and paralysis.

So what happened? Here’s an excerpt from a podcast interview Ben did a couple of years ago:

Interviewer: So what were you the CEO? Or were you both CEOs?

Ben: No, in the early days, that never really happened. It was just a bit like, right, this is a list of things that we need to do. Let's just tackle them as we go. There was no organisation in those days.

… in the early days, we were literally inseparable, and then there came a point where I had my vision, and he had his vision… so Lewis essentially left.

Oh, OK. Just a difference of opinion over the direction of the company, and so Lewis decided to leave? Seems reasonable.

But what does Lewis have to say on the matter?

On a different podcast, Lewis says:

“He [Ben] wants to say we had different visions — if he wants to clear his own conscience by making himself believe that, then so be it…

There’s a lot of skeletons in the closet that’ll never be spoken about because of contractual reasons…

Loads of nasty stuff went on behind closed doors though.”

Oh dang. That sounds salacious. But we don’t know any more than that, and it’s possible we’ll never know any more. Curse you, non-disclosure agreements!

What we can do is track the shareholding changes over time. It’s time to put our detective hat on, and do some sleuthing.

The evolving shareholder list of Gymshark

As mentioned earlier, Gymshark started with a very simple structure: Ben and Lewis each owned one share.

Couldn’t be simpler. Each share is worth £1, and vote. An easy 50/50 split of both voting and economic rights.

Over those first three years the co-founders grafted, and grew the business rapidly. By 2015 Gymshark was close to eight figures in revenue, around 35 employees, and looked set to keep expanding rapidly.

The company was a rocket ship, and they all knew it.

Which is why it’s incredibly surprising that at that point, as Ben Francis tells it, he decided to remove himself as CEO.

Ben says he got some 360-degree feedback from his leadership team that made him realise he wasn’t the leader he needed to be if Gymshark was going to fulfil its potential. He subsequently stepped down to Chief Brand Officer, and appointed an external CEO above him.

To put it in context, Ben Francis was just 23 at that time. He and Lewis had built a company that by that time was doing about £9m a year in revenue. And he decided to step down for the good of the company.

Assuming that is indeed what happened, I’ve got a huge amount of respect for that call. That’s a level of maturity, self-awareness and humility I wouldn’t have had at that age.

So, enter Steve Hewitt.

Steve came to Gymshark with a pedigree in the sportswear industry, having served 6 years as Commercial Director (EMEA) for Reebok. Steve was appointed as a director of Gymshark Ltd in June 2015, taking on the CEO role — as well as 5% of the company for his troubles.

At the same time, in June 2015, Paul Richardson, former director of All Saints Retail1, is appointed a director of Gymshark too, taking on the Executive Chairman role — but Richardson doesn’t get any shares at this point.

After a cheeky little 100-1 share split, and the creation of a new share class, we find ourselves with this shareholder list by October 2015:

One important thing to note: Steve Hewitt’s shares are a different class, B shares, than Ben and Lewis’s A shares.

This is pretty common. Often different share classes exist to assign different rights to each share class. Different share classes may have more or less power when it comes to shareholder votes, or dividends, or a claim on the company’s assets in the event of liquidation. That sort of thing.

In this instance, it’s so that holders of A shares (Ben and Lewis) had right of first refusal to buy B shares, which we can see in the filing docs:

This still all looks kosher to me. Ben and Lewis bring in an outside CEO — someone more mature, with industry experience, to help guide them — and give him some equity so that he’s got some skin in the game. But make that equity a different share class — just to make sure you get first right to buy his shares back, and you don’t risk losing control of the company. All makes sense.

Crucially, though, the B shares have the same voting rights as the A shares. Which mean if the two co-founders disagree, Steve Hewitt has the swing vote.

*ominous music*

Then we hit September 2016.

The great restructure of 2016

According to Ben’s Instagram page, he was on a Gymshark world tour in Canada at the time when all hell broke loose in a matter of days.

On 17th September 2016:

Gymshark Holdings Ltd is formed (originally named the Clade Group), and takes 100% ownership of Gymshark Ltd (the trading company).

Ben Francis, Paul Richardson, and Steve Hewitt are all named directors of Gymshark Holdings.

That same day Gymshark Holdings files its initial list of shareholders:

and Lewis Morgan’s name is nowhere to be seen.

We see from Gymshark Ltd’s filing in January 2017 that all shares of Gymshark Ltd had been transferred to Gymshark Holdings (aka Clade Group):

So we know that on 17th September 2016, the ownership structure of Gymshark looked like this:

Four days later, on 21st September 2016, a new list of shareholders for Gymshark Holdings gets filed, and Lewis is back on the list:

But his shareholding is now only 20%, down from the 47.5% he previously held. Ben Francis increases his stake to 67%, and Paul Richardson swoops in with a cheeky 6% of the company too:

That same day, Lewis Morgan resigns as a director of Gymshark Ltd.

And, y’know, maybe this is all a coincidence, but this happened to be the financial year in which Gymshark tripled revenue, and made nearly £10m in net profit, more than it had in all its previous years combined.

It’s possible that Lewis Morgan’s equity stake went down simply because he sold his shares. I can’t see evidence of that anywhere particularly — but if it was a private transaction between the shareholders, we wouldn’t see it.

But why would you hugely reduce your stake in a business when you know its value is about to skyrocket?

You wouldn’t.

Surely, you wouldn’t?

So it frustrates me to have to say this, because I hate throwing shade on successful British companies.

But it’s entirely possible that Lewis Morgan was forced out of Gymshark by Ben Francis, Steve Hewitt, and Paul Richardson.

Maybe Lewis Morgan got the full Eduardo Saverin treatment.

For four days, between 17th and 21st September 2016, Lewis Morgan appeared to have no stake in Gymshark at all. Or at the very least, it looks like Ben Francis, Steve Hewitt and Paul Richardson were forming a separate holding company without him.

Why?

Maybe it’s just a filing issue or a timing issue with Companies House — it’s entirely possible that Lewis just sold a big chunk of his stake to the other shareholders, including Ben, at a fair price.

Or maybe Lewis wasn’t pulling his weight and Ben and Steve did what they thought was right for Gymshark, which was to get rid of him.

Or maybe they used this restructure to somehow threaten Lewis to force him to sell his shares to them at a deep discount?

I really have no idea what the truth is here. But I love the drama.

The resolution

The morally ambiguous ending to this tale comes in August 2020, when private equity house General Atlantic plonks down a cool £200m to acquire 21.1% of Gymshark.

As part of the deal, co-founder Lewis Morgan sells his remaining stake for somewhere in the region of £100-200m. We don’t know exactly how much. But in the press release around the sale, his name doesn’t even get a mention:

Today the shareholder list is basically the same as it was following that transaction.

The only difference is that Ben Francis gave a big chunk of voting shares to his brother, which includes 1% economic ownership of the company. Ben also transferred half of his ownership stake into Francis Family Office Ltd (which Ben Francis owns 100% of personally):

Based on that valuation of $1.3bn — a valuation agreed in 2020, so make your own judgement about which way it’s gone since then — Ben Francis himself is worth around $900m.

In 2021, he felt he was ready to take the CEO seat back off Steve Hewitt, who moved into a non-exec chairman role.

And in 2023, Ben Francis was awarded an MBE.

Now, he even gets to do fun rich people stuff, like take £10m of his own money that’s been distributed out of Gymshark to his family office co, and lend it back to them at a 3% premium to the SONIA rate:

which, given the SONIA rate of ~5% per year, plus the 3% premium, means he’s making the best part of £1m a year just in interest! Isn’t being rich fun?

All you need to do is ruthlessly cut out your co-founder and best mate from the deal, and you’re golden.

This guy knows what I’m talking about:

Gymshark part 2, next week

There’s actually a bunch more in the Gymshark story that I want to talk about — bringing in external talent, identifying your best role in the business, managing working capital in a brutally cash-hungry business like ecommerce — so we’ll be doing a Gymshark part 2 next week as well.

But with Succession finished for good, I was looking for a slice of boardroom action, and I just couldn’t resist diving into this side of the Gymshark story.

Speak soon.

Andrew

EDIT: part 2 is out! Head here to read more about co-founder exits, billionaire tax planning, securing the bag, and cash crunches.

Or so he says. I actually can’t find any record of Paul Richardson ever being a director of All Saints Limited. He’s not on the list of directors past and present at Companies House, for example.

what a beautiful piece, Andrew! Kept me on the edge of my seat.

Hopping right into part 2, 1:20am on a Sunday, letsgo

Love the boardroom drama. I suspect it’s probably somewhere in the middle, with shitty emotional decisions made by both sides.

Definitely worth watching all the BTS of their warehouses and offices on their YouTube. Their warehouses are unfathomable. He just dropped one about their factories in Asia, too.

Maybe it’s time to watch Margin Call again...