A quick update on Net Income

Scheduling a return in two weeks

Hello! I hope you’ve had a wonderful summer, with plentiful cashflow and balance sheets that actually balance.

A quick note from me: you might have noticed that in classic European style, I took a brief hiatus from Net Income over the summer. I’ve been busy sorting a new professional opportunity (more on that in the coming months), finishing our house renovation, and taking some well-needed rest. When I wasn’t working, exercising, or sleeping, I was doing my second job as an amateur landscaper to finally finish this beautiful deck:

and here’s the full before and after for context:

This has taken an awfully long time, but it’s totally worth it. It’s nice to actually create something with your own two hands — something you can see and touch, rather than just another spreadsheet or blog post.

Finally, today my wife and I celebrate 5 years of marriage, and tomorrow we’re off on a week’s vacation. Please send me your book recommendations — just hit reply and let me know what you think I should read.

Net Income will return on September 15th to finish off our Serif story, before taking a detour into the world of — ahem — ‘adult entertainment,’ to look at one of the best acquisitions of all time.

Going forward, expect posts every two weeks. In my mission to be the perfect blend of the Acquired podcast and Wait But Why blog, I want to err on the side of quality over quantity. If you’ve read any of my earlier posts, you’ll appreciate the time and effort that goes into writing Net INcome (on the side of a full-time job). I don’t want to drop that quality bar just to hit an arbitrary, self-imposed weekly schedule — my mantra is less, better.

To tide you over until my return, you can visit the back catalogue. As a reminder, we’ve covered:

Center Parcs: analysing the PE structure of this real estate and hospitality gold mine

How rich is former Manchester Utd footballer Gary Neville, really?

A deep dive into the boardroom drama at Gymshark, part 1 and part 2.

And if you want a little more, some supplementary reading:

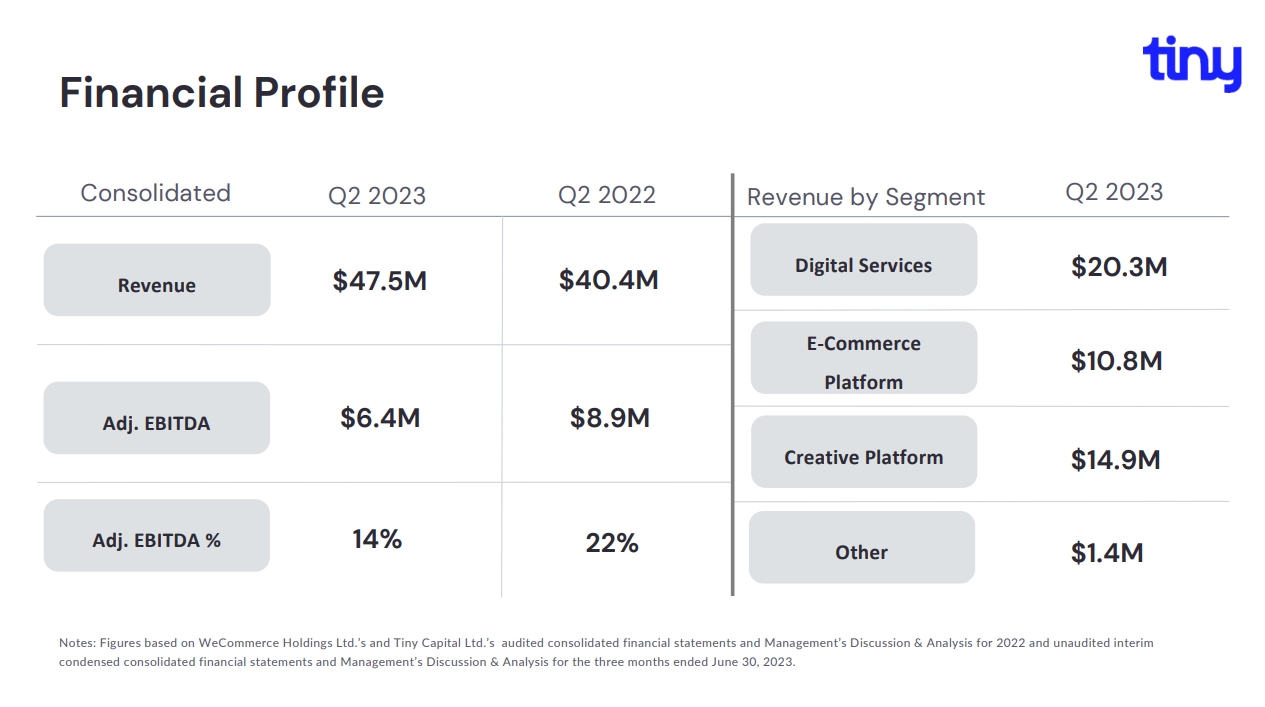

Lastly, I’m a huge fan of entrepreneur Andrew Wilkinson and his company Tiny Described as the ‘Berkshire Hathaway of the internet’, Andrew and his team have built a wonderful holding company which recently went public — which means all their numbers are now public. You can check out their latest investor presentation here, which is well worth a read — they own Metalab, dribbble, Aeropress, girlboss and more, and the group now does around $150m a year of revenue at ~20% EBITDA margins:

which is fairly stunning for a company that started as a web design agency back in 2006. Andrew’s journey is an inspiration to me — who knows, maybe one day we’ll look back on Net Income as the start of my media empire.

As always, I genuinely, deeply appreciate your support for Net Income — writing and sharing this is a blast for me, and you taking the time to read it means the world to me.

Speak soon.

Andrew

Carve outs

I LOVED this podcast from the Acquired guys about Costco. Their business model is wonderful — for more, check out this incredible deck that dives deep into the strategy, business model, and financials / market comps.

I get asked all the time if there’s a UK-based accounting firm I can recommend for small businesses. I’ve never had a good answer — until now. The company is Ashton McGill, run by my friend Jared Cordner. No affiliate relationship, they just put more focus on customer experience than any accounting firm I’ve seen before.

I’m getting back into chess — far and away the best and most entertaining resource for improving is GM Daniel Naroditsky. Daniel has created several ‘speedruns’ where he plays at every rating level from true novice (ELO rating of ~ 500) up to master level (ELO rating of ~2200), and explains how to master the game at each level. Fascinating to watch, and Daniel’s a great teacher.

Don't have any book recs at the moment, but the garden looks awesome!